Transaction costs in the Ethereum system are climbing higher and higher. Since there is no established scalability solution yet for Ethereum transactions, the efficiency of token standards is gaining in importance. Already in traditional software development, simplicity is very valuable as it keeps a system easy to understand, maintain, and change. On the blockchain, simplicity also comes with lower transaction costs and therefore with an immediate monetary payback. We took a look at three security token standards for the Ethereum system and how efficient they are. It turns out that token transactions under the Aktionariat standard are almost as cost-efficient as plain ERC-20 transfers, whereas share transfers with the T-REX standard or the CMTA standard (Mt. Pelerin implementation) come with much higher transaction costs. It is apparent that neither of them has been designed with today′s Ethereum system in mind.

The Benchmark

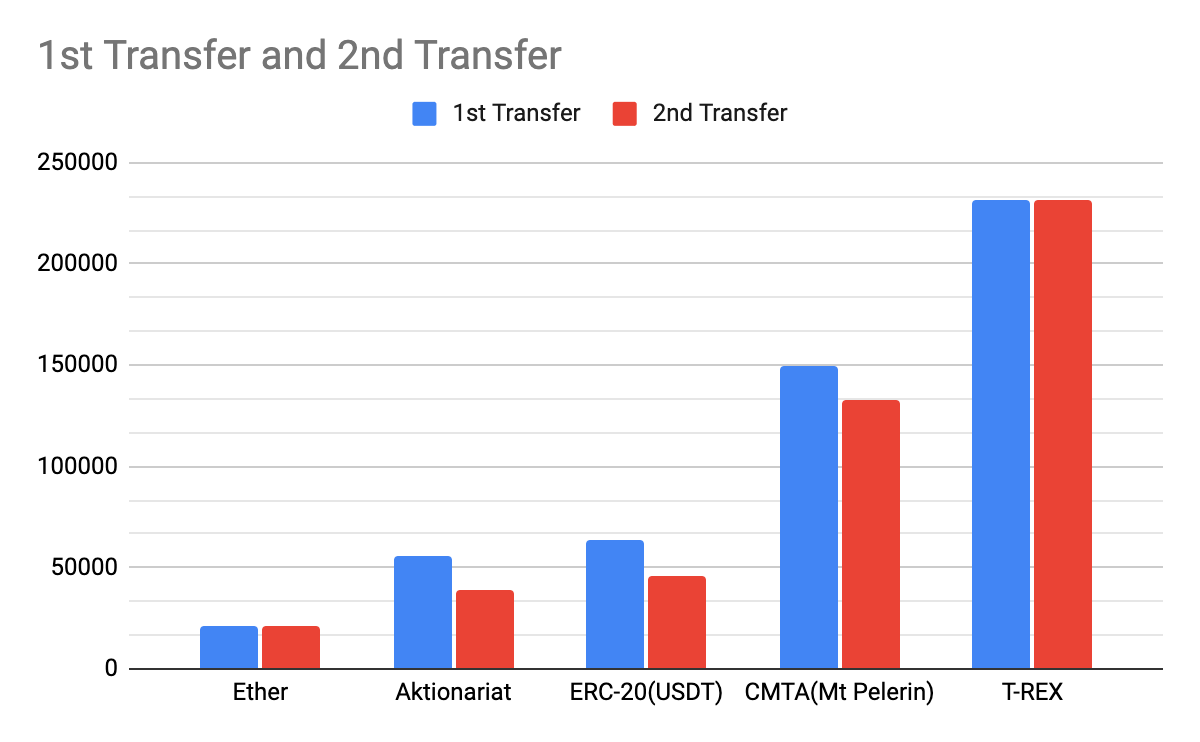

To compare the transaction cost we looked at the transfer function of the tokens. With a block explorer like etherscan.io it is easy to look up the real costs on-chain on the ethereum mainnet. We check two transfers: the initial transfer to a new address, which is in general more expensive because storage has to be allocated for the new address; and a subsequent transfer to an already existing address.

As reference points we take a native Ether transaction and a typical ERC-20 transfer with the most popular stablecoin, namely Tether (USDT). The costs for the native Ether transaction are 21′000 gas, which is the bare minimum as there is no smart contract interaction at all when sending ETH. Sending USDT to a new address costs around 60′000 gas. At an Ether price of $3500 and gas costs of 50 GWei, that is about $8 for the Tether transaction and $3.70 for the Ether transaction.

How do the T-REX, CMTA (Mt Pelerin), and Aktionariat token standards compare to that?

The Result

As you can see in the chart, the T-REX and CMTA (Mt Pelerin) transfers are up to five times as expensive as a typical ERC-20, whereas a transfer with Aktionariat tokens is even slightly cheaper. In dollar terms at current gas prices, that means the transfer with Aktionariat costs around $7, respectively $23 with CMTA (Mt Pelerin) and over $40 with T-REX.

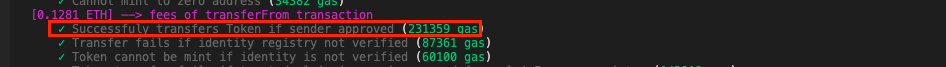

Going into the detail, finding on-chain data for T-REX is hard as Tokeny Solutions isn′t disclosing their customers. Cloning their open source repository and running their tests locally the transfer costs 231′259 gas.

Seeing the costs are quite higher than average ERC-20 transfers, it is not surprising that Tokeny Solutions is using Polygon as a scaling solution to push the gas fees for T-REX usage down.

Mt Pelerin has their own shares tokenized on Ethereum and also other tokens using their contracts can be found.

The initial transfer with 149′813 gas and the subsequent transfer with 132′713 are much higher than the average ERC-20 transfer.

Looking for the same on-chain transfers for Aktionariat the initial transfer costs 55′998, while subsequent transfers cost 38′910 gas, even cheaper than an USDT(ERC-20) transfer.

Conclusion

When you plan to issue a security token in the Ethereum system, it is paramount that you have a look at the transaction costs that come with the chosen token standard. Token standards that come with a plethora of built-in features are naturally more complex and therefore also less efficient. Normally, efficiency is an afterthought in software development as computers have become so fast and most users do not notice whether something takes only a microsecond or ten microseconds. However, on the blockchain, complexity is very costly and must be taken into account. For most users, it makes a big difference whether a transaction costs 10$ or 100$. Therefore, gas efficiency should be taken into account and bloated standards avoided when choosing a token standard for issuing securities on the Ethereum blockchain.

Outlook

At first sight, it would seem like you cannot have both a feature-rich token and efficient

transactions. However, we are working on an upgrade to our token contract that can offer

advanced features with minimal overhead by making more efficient use of the available variables.

What mostly drives transaction costs is writing data to permanent storage, reading from

permanent storage, and jumping back and forth between different contracts. All three of these

are far from being optimally done in the benchmarked contracts. If you are interested in issuing

a token that is both efficient and rich in built-in features (for example whitelisting), get in touch.