Investing & Trading for Private Company Equity

Raise capital through direct investments and enable transparent secondary trading - all in one integrated platform.

A Transparent Investing & Trading for Your Company's Shares

Attract potential investors with the easy tool to make direct investments and enable your shareholders to buy, sell and trade shares in a compliant secondary market - directly on your Investor Page

The Challenge We Solve

Without structured trading infrastructure, private shares remain illiquid and difficult to transfer. Manual processes, limited transparency, and lack of standardization restrict access for both companies and investors. Market & Trading introduces a compliant and structured alternative.

Benefits for Companies and Investors

Liquidity for Shareholders

Enable shareholders to buy and sell shares through a structured primary and secondary market. By creating continuous trading opportunities, companies reduce long holding periods, improve shareholder satisfaction, and make private equity more attractive to new investors.

Transparent Trading Environment

All transactions are executed in a clear, compliant, and auditable trading environment. Shareholders see real market demand, pricing mechanisms, and transaction history. With Aktionariat’s solution companies create trust and ensuring fair market access for all participants.

Stronger Investor Relations

An active share market keeps investors engaged beyond the initial investment. Companies gain deeper insights into shareholder activity, improve communication through their Investor Page, and build long-term relationships with a more involved investor base.

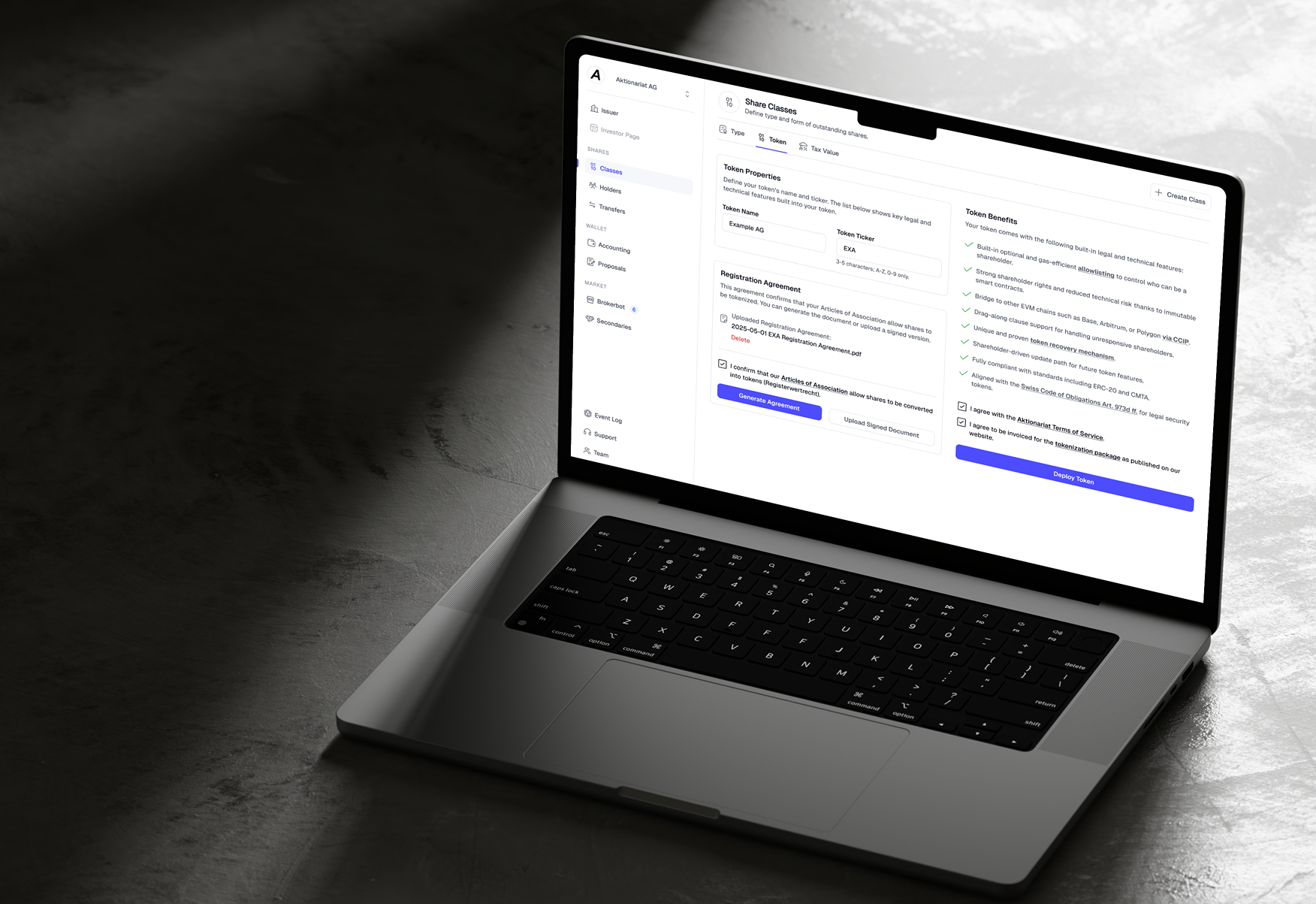

Why Investing & Trading Direct investments and secondary trading for tokenized shares

Enable continuous capital raising while giving shareholders a transparent marketplace to trade. Both markets work together to create liquidity and attract quality investors.

Automated Market Maker

Continuous treasury share sales with bonding curve pricing that adjusts automatically based on supply and demand.

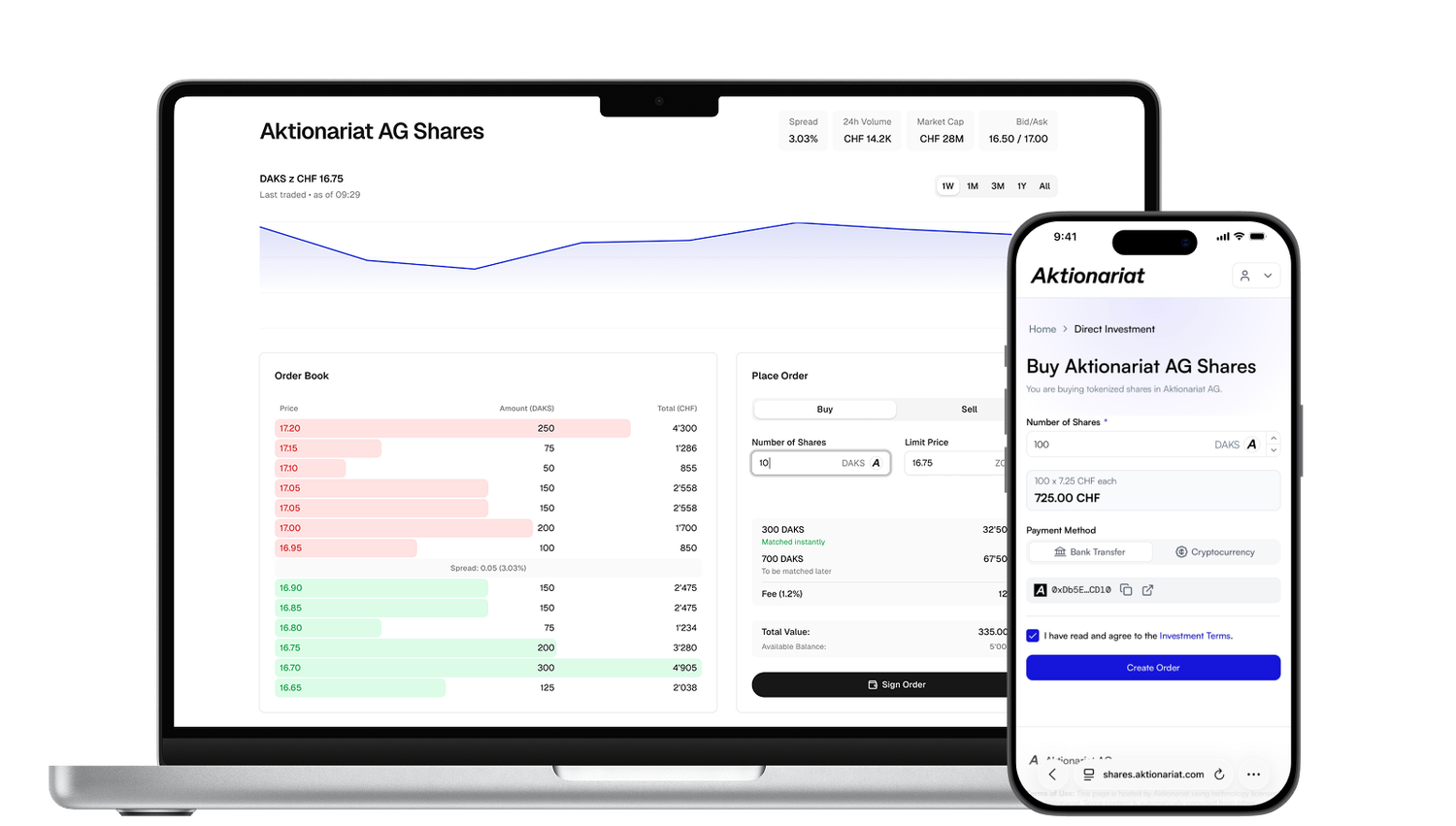

Order Book Trading

Real-time peer-to-peer trading with transparent order matching between shareholders.

Instant Settlement

Blockchain-based trades settle in seconds with automatic share registry updates.

Flexible Pricing Controls

Set your base price and price curve steepness to control how pricing responds to trading volume.

Powered by Aktionariat's Core Products

Investor Page

Portfolio App

Interested in more?

Start today for free or let us show you how it works.